History

on 09.06.14

There's an op-ed on Ebola in the Times by researcher Pardis Sabeti, who says, elsewhere.

"My father took one of the toughest jobs in the government because he cared about his nation more than himself," Pardis says. "His courage and conviction have always driven me to want to make a difference."

Silence would have been better, kid.

Guest Post - I don't fully understand this...

on 09.06.14

(writes Witt): ...but it seems cool. Also, there is a map.

Federal government releases state-by-state data on personal consumption patterns from 1997-2012. From the announcement:

Today, the U.S. Bureau of Economic Analysis released prototype estimates of personal consumption expenditures (PCE) for states for 1997-2012. These new estimates provide insight into household spending patterns across states that can be used together with other regional data to gain a better understanding of regional economies.

Reviews

on 09.05.14

From the worst review ever (since retracted), to the worst reaction to a review (I'm guessing: probably not). Scroll down to the comments on that latter link. Worth it.

Education Corporations

on 09.05.14

I don't know which of these is the more depressing description of how textbook and testing companies are sabotaging our schools.

Dr. Walter Stroup, at the University of Texas, testified that standardized tests weren't measuring what they were supposed to be measuring. The UT ed department receives a significant amount of money from Pearson. Buried at the bottom of the article is the methods Pearson used to try to ruin Stroup's career:

In January 2013--six months after his testimony and less than a week after a story featuring Stroup aired on the Austin ABC affiliate--he received the results of his post-tenure review. It was bad news. The committee gave Stroup an unsatisfactory rating. Under state law, a public university in Texas can remove a tenured professor if he or she gets two successive unsatisfactory annual reviews. A Post-Tenure Review Report dated Jan. 10, 2013, dinged Stroup for "scholarly activity and productivity." In sum, the committee found he was publishing too little and presenting at conferences too seldom. Of his infrequent conference presentations, the committee members wrote, "Further, and equally concerning, is the paucity of presentations at research conferences. Dr. Stroup lists no presentations (competitively reviewed) at research conferences over the past six years (none since 2005)."

That was a curious conclusion, because Stroup had been presenting. When a professor undergoes post-tenure review, he or she completes annual reports using a form published by the Office of the Executive Vice President. Stroup's annual report lists four conference presentations, including two plenary addresses.

Regarding the overall charge of lack of productivity, the review committee failed to note Stroup's work with cloud computing, which led him to a group approach to education technology called "cloud-in-a-bottle" that is being implemented now at Lamar Middle School in Austin. In addition, his work with Texas Instruments on the math intervention program had led the company to create its Navigator system. All of this was in his annual report.

Stroup protested, citing these omissions, misstatements and errors. On Jan. 16, Committee Chair Dr. Randy Bomer submitted the post-tenure review report to the dean of the College of Education after changing Stroup's rating from "unsatisfactory" to "does not meet expectations." Bomer did not, however, correct any of the errors in the committee's report.

Ugh. The second article is how testing companies write tests that are gamed to force teachers to use their textbooks, and how poor schools (with a focus on Philadelphia) are much less likely to have the textbook that spoonfeeds the answer to the test.

Ain't life grand. On a more positive note, our renovations are FINISHED!! I should post photos to the flickr group or something.

Hi, I have way worse taste than I think I do

on 09.04.14

And I'm a total sucker for the current vogue for overwritten limp "lyrical" prose, too, and I want everyone to know.

NMM

on 09.04.14

RIP, Joan Rivers. I'm weirdly fond of her, mostly for making it as a comedienne in the 60s and 70s.

No Choice, Really

on 09.04.14

When given a choice, which colleges do kids choose to attend?

The Life Of The Mine

on 09.04.14

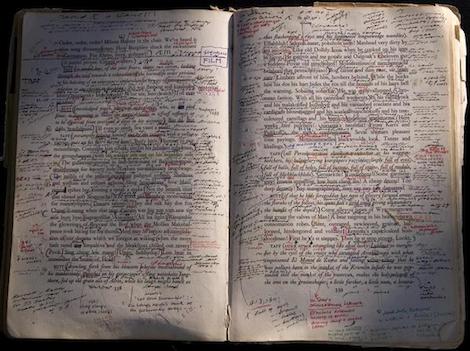

Perhaps you've seen this picture of pages from Susan Sontag's copy of Finnegans Wake.

On the one hand, I get it. There's a thrill and reward from wrestling with a text and feeling it reveal more and more of itself to you, and I also appreciate the patience and dedication that something like this requires. She gave a damn, and giving a damn is often its own reward.

On the other hand, I would never undertake something like that today. What, ultimately, is it going to reveal to me? An impressive achievement of the human mind, sure, but I'll still have to wipe the counters, not yell at my kids, be a decent human being, die gracefully, etc., and at my age, nothing one guy wrote is going to make enough difference to justify this kind of effort. I'm sure it's quite nice, dear, and all that.

Liquid Television

on 09.04.14

I used to watch Liquid Television, but always with the conviction that I didn't quite get what was going on, and that better people better understood the art form. So I can't really say I enjoyed it at the time, but I have a little fondness for my perseverance. Anyway, they're releasing the archives. Did anyone here really get it? Can you explain it to me?

Piketty Reading Group: Chapter 16

on 09.04.14

No need for future scheduling notes -- Fake Accent opines on Chapter 16, and the book as a whole, below.

Prior reading group posts:

Piketty Reading Group Setup

Initial Scheduling Post

Introduction and Chapter One -- Robert Halford

Chapter Two -- Minivet

Chapter Three -- Essear

Chapter Four -- Unimaginative

Chapter Five -- X. Trapnel

Chapter Six -- Conflated

Chapter Seven -- LizardBreath

Chapter Eight -- Lw

Chapter Nine -- Bave D

Chapter Ten -- Rob Helpy-chalk

Chapter Eleven -- LizardBreath

Chapter Twelve -- Chris Y

Chapter Thirteen -- Thorn

Chapter Fourteen -- Parenthetical

Chapter Fifteen -- Minivet

Chapter 16 is the last chapter of Capital in the 21st Century, by Thomas Piketty. It is titled, "The Question of the Public Debt." It consists of 30 pages, divided into 10 subsections with titles like "Reducing Public Debt: Tax on Capital, Inflation, and Austerity" and "The Euro: A Stateless Currency for the Twenty-First Century?" Topics include debt, inflation, banking data information exchange, European governance, and more. I read this chapter really, really, really, really, really, really, really, really, quickly a couple of days ago. Uh, have I reached the word minimum yet?

But seriously, I actually did read the chapter (and the book too). It's not that easy to sum up. Piketty touches on a number of topics that have come up earlier, but I felt like he was using this chapter more as a vehicle to talk about a bunch of stuff he wanted to cover before the end of the book rather than to cover the topic of public debt in detail. I suspect that people would rather talk about the book overall at this point - since we've all finished it by now* - so I'm going to do just a quick overview of the chapter and then move on to some general thoughts on the book. Also, I only slept three hours last night and am re-skimming the chapter as I write so some of this might not make sense.

Piketty starts off by noting that governments have to pay their bills somehow and there's really only two ways to do that: collect taxes or borrow money. As you might expect, he thinks taxes are the better option, from both a justice - well-designed taxes will have a redistributive effect - and efficiency standpoint. Debt, on the other hand, has to be paid back and the creditors are generally going to be people who already have a lot of wealth.**

The problem for the wealthiest countries is that their governments are (as an overall average) currently in debt to the extent of about one year of national income, which is the kind of debt last seen around 1945. Public debt is generally much lower in the less wealthy or "emerging" countries, so this is less of a concern for them for now. Europe is in an especially difficult situation, which becomes a focal point of this chapter later.

But first: what is to be done about public debt? Three possibilities: You could tax capital (where have we heard this one before?). You could rely on inflation, which has worked in the past. Or you could go for austerity, which is what Europe has been doing, but which Piketty thinks is the worst option of the three. Piketty also mentions, in order to dismiss, the idea of privatizing basically all government assets, including buildings, schools, hospitals, etc. Even if a massive government asset sale could cancel out the debt, it would cause many other problems in the longer run. Piketty says he only brings this up because some people seem to think it's a serious option. ***

Briefly, the options worth considering:

Tax on capital: good for redistribution of wealth, better than repudiating debt outright. I'm glossing over the details of how to structure the tax but Piketty talks about that.

Inflation: it's worked in the past, but it can take a long time to have an effect and in the meantime its redistributive implications are not so clear. It could end up hurting people with "modest" capital more than people with lots of it, who have more ways of protecting their wealth from inflationary effects. Inflation could also spiral out of control and then what would you do with your mattress filled with cash? Sleep on it? Maybe, but not soundly.

Austerity: Just kidding! We're not really going down the full list like that. Actually I'm not sure he comes back to austerity as a general strategy rather than as applied specifically in Europe. Because...

Let's talk about central banks now. Central banks have played various roles in various places over the years, but mostly they now serve as lenders of last resort with a primary goal of maintaining the stability of the financial system. The big point Piketty makes here is that central banks can redistribute wealth, for instance by picking who or what to prevent from failing, but they don't create capital by themselves. There's also some things they can't do: set the rate of inflation, make people with capital actually invest that capital in stuff, make the economy just plain start growing again. They can also make the wrong choices. Overall, Piketty sees central banks as playing an important role in maintaining stability, but one that should be carefully limited.

Now that we've covered central banks, let's talk about Europe, but before getting into the Euro, let's talk about Greece and Cyprus. Actually, let's talk about them in the comments, if you'd like. There's a lot of detail here that I vaguely knew or learned for the first time and I'm just not going to summarize it. But there are a couple of important takeaways: first, governments and international institutions like the European Commission, European Central Bank, and IMF don't have the kind of international banking data they need to be able to target their interventions precisely. Also, private individuals can just move their wealth around the globe to evade nation-level taxes, so there has to be a way of getting at that wealth for tax purposes even if it's gone abroad. Finally, legitimacy, democracy, and transparency are all important but have been lacking to various degrees in interventions (or proposed and rejected interventions, in cases when the to-be-intervened-in state rejects a course of action handed to them from on high).

Ok, now the Euro. It's got problems. Or more precisely, the Euro zone has problems. The European Central Bank is too restricted by a mandate to keep inflation down. The member countries all have the same currency, but their debts and budgets are done separately. No national currencies means that individual countries don't have a currency they can devalue, even when that would be the logical thing to do.

So what's Europe to do? Set up another international governance institution to deal with the Euro zone specifically, but you know, make it actually work unlike those other already-existing European institutions that aren't working so well, but which aren't currently coterminous with the Euro zone.**** I'm being more glib than I should be, out of sleep deprivation and a sense that this "brief" summary is actually going on forever, but I think Piketty is right about what's needed even if it's not clear how to get there. Consistent with the rest of his argument about the need for a global tax on wealth, he doesn't advocate splitting up the currency union. The underlying problems of the Euro zone, as he sees them, have to be solved with greater, not reduced, international cooperation, especially on taxation and budgeting. If countries went their separate ways, this could result in even more international competition for lower taxes, less regulation, and less transparency in order to attract capital. Tighter European cooperation could also be a step towards global cooperation.

Wait, weren't we talking about public debt earlier? Let's come back to that. Piketty asks: "What level of public capital is desirable, and what is the ideal level of total national capital?" Ha! Wouldn't you like to know! You could do a bunch of math and set some ideal rates but it's not going to give you an easy technocratic way out stamped with the legitimacy of economic science QED. Instead, you're just going to have to work out some answer through a process of democratic deliberation which will be constantly subject to revision over time. Sorry. (But have you considered taxing capital?)

So, yeah, climate change is also a subject. Let's give that a couple of pages. If you were waiting for Piketty to make a sustained discussion of "natural capital", you should know that patience is a virtue that isn't always rewarded. I was actually hoping he'd say something about the distribution of natural resources but I guess either I missed it or he never really does. He uses the phrase "degradation of natural capital" a few times and I take it that's something we should try not to do. Climate change is a bigger problem than debt, since the possible fixes for debt are more implementable than the fixes for climate change (a global tax on the sun?) Piketty is pretty open about the uncertainty here as to how bad things might get.

And there's one more section. Financial transparency: let's do this. Collect and publicize more reliable, accurate financial data. Reform corporate governance and bring more people into corporate decision-making. Piketty specifically mentions putting workers on companies' boards of directors. All of this sounds good to me, but at this point he's just packing in statements.

And then the conclusion. If you've read this far - not just this post but the reading group - I don't think I need to summarize it. If you haven't I'm sorry but I'm going to sleep soon. I think we've already covered all of Piketty's major arguments in this reading group series of posts. I'll just end with a few observations:

1. Has Piketty ever read an American novel? I'm kind of serious. He mentions Henry James a couple of times but at one point specifically references a film adapation of a James novel, leading me to wonder if he read the novel itself. He could have made some additional points about the American ideology of work vs. speculation with reference to Twain and Warner's Gilded Age, but doesn't. Before you object: "Who would get a Gilded Age reference?", how many Balzac references did you get? Have you all read Pere Goriot or something?

2. Piketty repeatedly makes suggestive statements about what an even more deeply unequal future would look like politically and socially. There are a number of times when he talks about potential violence from below that could only be held off by violent repression or some extraordinary "means of persuasion".

But overall he seems hesitant to draw connections between the economics of capital and political and social relations, except to the extent that politics shapes the policies that structure the distribution of wealth and income specifically. At one point he refers to the "shocks" of the 20th century as "accidents." This is not, to put it mildly, how some earlier analysts of capital saw, for instance, the origins of the first world war.

I don't think this is necessarily a weakness of the book, which is more about the accumulation of capital and the sources of inequality than it is about their consequences, and which is already quite long, but it is something to think about.

3. How does, for lack of a better phrase, non-intergenerational family structure, such as marriage, fit into Piketty's analysis? Maybe I read too quickly to notice it, and I didn't check any footnotes yet, but it doesn't seem like he addresses this at all. Does it make a difference to the data analysis if someone with no or little wealth marries someone with a lot of wealth?

I need to go to sleep so I'll stop here. In conclusion, heiresses above a certain wealth/income bracket: call me.

*Right?

**Or to put it in more formal language, motherfuckers need to be paid, and to borrow on this scale governments are going to have to deal with some rich motherfuckers.

***Piketty says this idea has been put forward by some "very serious persons"; I wonder if that phrase is an accident of translation or concsiously chosen?

****I think; I haven't looked up the borders.

Death Row

on 09.03.14

Another day, another exoneration. This one particularly...poetic? Depressing?

Justice Antonin Scalia pushed back, highlighting a convicted killer named Henry Lee McCollum as an obvious example of a man who deserved to be put to death. "For example, the case of an 11-year-old girl raped by four men and then killed by stuffing her panties down her throat," Scalia wrote in a 1994 ruling. "How enviable a quiet death by lethal injection compared with that!" For Scalia, McCollum was the perfect example - a murderer whose actions were so heinous that his crimes stood as a testament to the merit of capital punishment itself. Yesterday, a judge ordered McCollum's release. Scalia's model example was innocent all along.

It's something.

In Soviet Russia

on 09.03.14

Why are Russians dying in droves? Just because it's a macabre, Russian thing to do? Kind of, yeah. Tragic and fascinating.

Via Apo

Climate Best By Government Test

on 09.02.14

On a lighter note, here's a graphic of the places in the US with the most "pleasant" weather. It would be more fun if it were more surprising, but coastal California is great and Montana sucks and we all, even Charley, in his little heart of hearts, knew that. I would have liked to see data for smaller places, too, because Redwood City or Palo Alto are (I'd guess) notably more pleasant than even the winners here.

Rotherdam

on 09.02.14

The Rotherdam sexual abuse scandal is really stomach-turning in its scope and depravity. At the other place, some of you are talking about the bizarre way that the racial aspect was handled. The whole thing is crazy.

Via you, there.

Halford Wins

on 09.01.14

Some [recent studies] have provided strong evidence that people can sharply reduce their heart disease risk by eating fewer carbohydrates and more dietary fat, with the exception of trans fats. The new findings suggest that this strategy more effectively reduces body fat and also lowers overall weight.

The new study was financed by the National Institutes of Health and published in the Annals of Internal Medicine. It included a racially diverse group of 150 men and women -- a rarity in clinical nutrition studies -- who were assigned to follow diets for one year that limited either the amount of carbs or fat that they could eat, but not overall calories.

"To my knowledge, this is one of the first long-term trials that's given these diets without calorie restrictions," said Dariush Mozaffarian, the dean of the Friedman School of Nutrition Science and Policy at Tufts University, who was not involved in the new study. "It shows that in a free-living setting, cutting your carbs helps you lose weight without focusing on calories. And that's really important because someone can change what they eat more easily than trying to cut down on their calories."And.

In the end, people in the low-carbohydrate group saw markers of inflammation and triglycerides -- a type of fat that circulates in the blood -- plunge. Their HDL, the so-called good cholesterol, rose more sharply than it did for people in the low-fat group.

Blood pressure, total cholesterol and LDL, the so-called bad cholesterol, stayed about the same for people in each group.

Nonetheless, those on the low-carbohydrate diet ultimately did so well that they managed to lower their Framingham risk scores, which calculate the likelihood of a heart attack within the next 10 years. The low-fat group on average had no improvement in their scores.

Labor Day! Labor Day! Schools are closed and POOLS ARE OPEN!

on 09.01.14

Labor Day! Labor Day! Do all your shopping at Wal-Mart!

Spider pics below the jump.

What is that drip of pus running down the wall, from behind the picture I just hung on the wall? The picture that has been sitting, dusty, stored in the corner of my bedroom for a few months?

Oh, I popped this spider, which was living on the back of the picture:

and is now running desperately up the wall, away from the picture, (but we smushed it and flushed it down the toilet like responsible people.)

Clearly one of the grossest things that's ever happened to me.